We’ve written before about how the notice process isn’t as simple as it may seem. Even the question of when to provide notice can be complex.

Once notice is given, claims that trigger several years of insurance policies can quickly lead to hundreds of letters exchanged between you and insurers, and amended complaints may require additional rounds of notice (and may include novel insurers as well). Because insurance policies generally require you to cooperate with your insurer(s), you must also keep track of information requests and respond in a timely manner. Failure to do so could jeopardize coverage.

Fortunately, technology can make coordination with outside counsel and other parties less onerous.

For KCIC clients, we capture this information in a database so that it can be quickly related to policy and claim information and reported to stakeholders. Then, we generate notice tracking reports that are designed to give you, the policyholder, and your coverage attorneys the best tools to manage obligations when faced with a claim.

Recently, we have taken the reporting to the next level by pushing dynamic reports to our Ligado Platform to track not only correspondence between parties, but also to track outstanding tasks and who is responsible for completing them. These reports leverage Microsoft’s Power BI reporting platform to maximize organization and mitigate pain points often found in conventional tracking systems.

Advantages of this unique tracking and reporting system are highlighted below:

Advantage #1: Instant Access to Correspondence

One limitation to keeping up with correspondence solely using email and Excel sheets is the inability to quickly recover exact correspondence three months or three years after it was received. Email works fine when organizing a handful of letters, but as volume grows, tracking replies and recovering files can cause headaches.

In contrast, our notice correspondence report provides comprehensive, high-level summaries and offers instant access to the source correspondence as downloadable PDFs from a secure, cloud-based storage site. Among other advantages, this instant access allows you to quickly reference specific language from the correspondence or send copies to insurers as proof of notice.

Advantage #2: Advanced Searching and Filtering

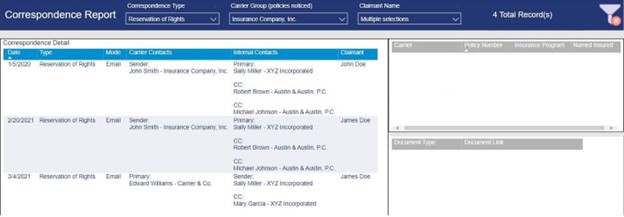

When you search for specific letters or groups of correspondence that meet criteria, the notice correspondence report offers several filtering options based on individually coded fields. These filters can be customized to fit your preferences. As seen in Figure 1, they often include sent or received date, carrier group noticed, claimant, and the status of any follow-up tasks stemming from the notice. This filtering method is a powerful alternative to the basic search functionalities available in email.

Figure 1

Advantage #3: Interconnectivity with Policy Data and Language

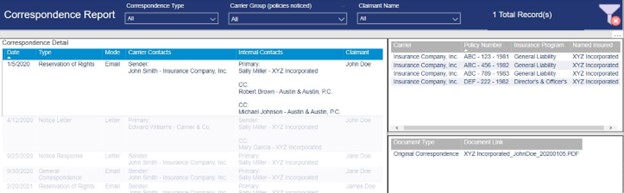

Since it is helpful to have a full view of your coverage, the notice correspondence report is integrated with the policy database we build for you. Illustrated in Figure 2, when a record on the report is selected, the report details the noticed policies that are related to correspondence. These policies can be directly referenced when you search on Ligado’s policy site to find specific language, additional named insureds, and other information. This allows for advanced policy analysis in response to a reservation of rights or denial of claim letter.

Figure 2

Advantage #4: Tracking Follow-Up Tasks

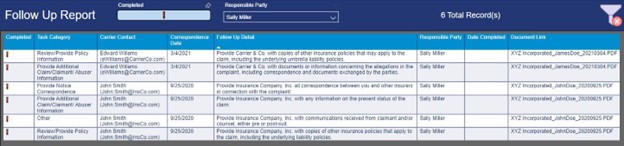

After notice is given, you may want information about what your insurers have requested and when. Therefore, we created a separate report that gives you live follow-up task tracking. The follow-up report displays a to-do list of items generated from our review of the correspondence and links each task to the original letter it came from. As with the notice correspondence report, the follow-up task report is filterable, allowing you to single-out tasks assigned to a specific person or involving a particular carrier. Once the task is finished, our team will update the report with the completed date and party responsible. Figure 3 illustrates what this report can look like.

Figure 3

It is no surprise that meeting policy expectations can become demanding when coordination is required between multiple parties. Luckily, innovative technology is available to support this charge.

If you are an insured, what tools or reporting features would help improve your notice processes? We encourage you to share your ideas. If you would like to learn more, we invite you to reach out to Nick Sochurek at sochurekn@kcic.com to schedule an online demonstration.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas